Who is eligible for ERAP?

Residents who meet the following criteria are eligible:

- Rent in County of Union

- Cannot be renting a homesteaded property

- Cannot be related to their landlord

- Cannot be relocating to new location

- Financially impacted due to the COVID-19 pandemic starting April 1, 2020. Examples of COVID-19 impact:

- Qualified for unemployment compensation benefits

- Experienced a reduction in income

- Incurred significant costs or experienced other financial hardship, due directly or indirectly to COVID-19, that threaten the household’s ability to pay the costs of the rental property

- Households seeking rental assistance must have an active lease with past-due payment

- Households seeking electric or gas assistance must have a past-due rental payment and a past-due electric bill and/or a past-due gas bill

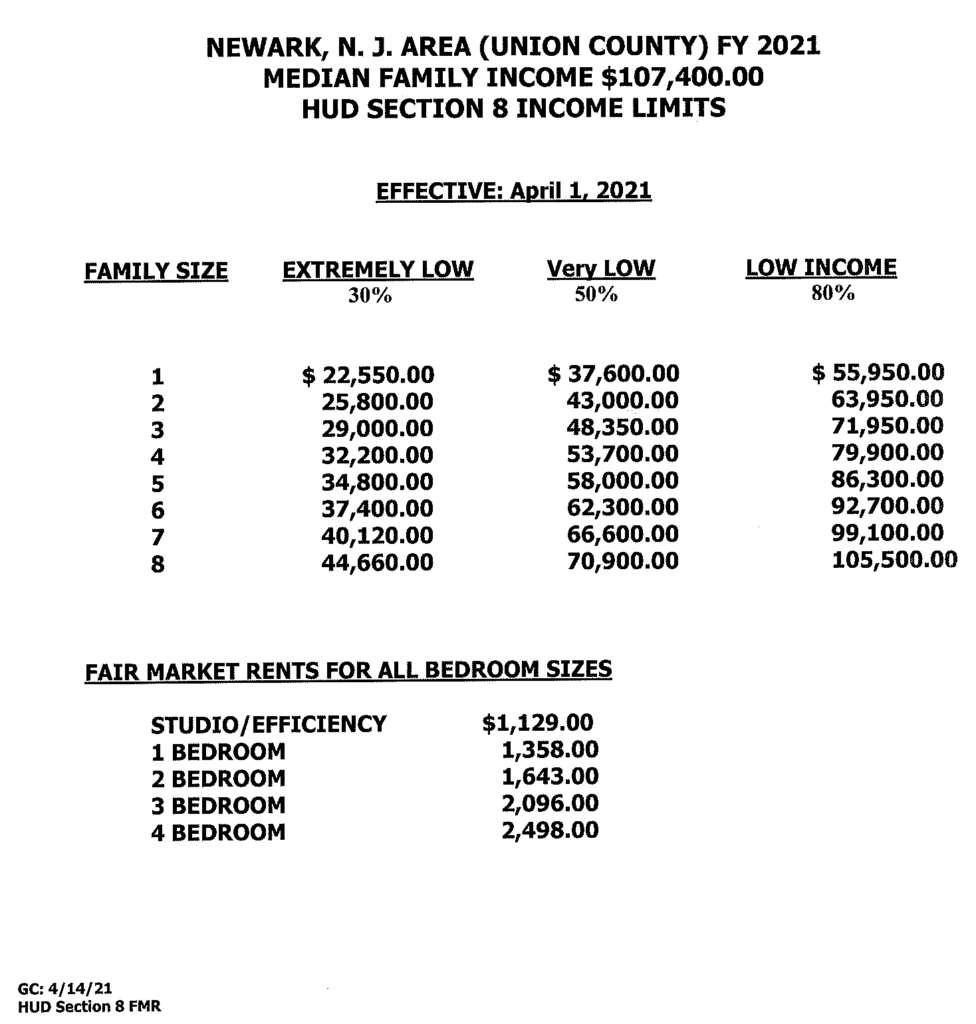

- Household income must be at or below 80% Area Median Income (AMI) as reported on 2020 Federal Income Tax filing (IRS form 1040 Adjusted Gross Income), or as calculated across all W-2 and/or 1099 forms. Priority access will be given to eligible households at or below 50% AMI or with zero income the 90 days prior to the application date.

What documents do I need to apply for assistance?

You will need all of the following when applying:

- Identification for all members of the household:

- Copy of valid (not expired) New Jersey driver’s license, ID card or passport for all adult household members, including yourself

- Copy of identification for all minor household members (birth certificate, school records, or immunization records)

- Signed 2020 IRS Tax Return(s) or 2020 W-2 and/or 1099 forms

- Depending on household makeup, multiple tax returns, W-2s and/or 1099 forms may be required

- For any households exempt from tax returns, other documentation explaining income status or waiver will be acceptable upon review. Copy of your active lease – must include pages showing lease agreement, applicant’s name, names of any other tenants (residing in home), leased property address, landlord’s name and address, amount of monthly rent (payment obligation), frequency of payments, lease start and end dates, clause related to non-compliance with lease terms (example termination/eviction clause), to whom rent is paid (if not landlord named), how and where rent is to be paid, and signatures of landlord and adult tenant(s). Other documentation may be acceptable upon review in the absence of a formal lease agreement.

- Proof of past-due utilities: copy of each month of your past-due utility statements – electricity and gas only, and the statement must clearly show the amount due and separate balances due for each utility type (must have the name of someone in your household).

These attachments may be in the following formats when uploaded: PDF, JPG, PNG, or Word document.

Note: If you do not attach all necessary files, your application will not be accepted, and you will not receive financial assistance.

How do I apply for assistance?

The Emergency Rental Assistance Program online application portal is open for eligible residents at or below 80% Area Media Income (AMI) or with zero income 90 days prior to application date. Review eligibility criteria and requirements before applying.

If you experience problems when applying or have questions about the program, you may call 1-866-657-4273 to speak with a Customer Call Center Representative, email unionerap@njshares.org or text HELP to 64405, for support and guidance. The call center is open from 9 AM until 5 PM EST Monday through Friday.

Important Notice: Applying for the ERAP is free and one-on-one application assistance for tenants is available in multiple languages by contacting the ERAP NJ Shares Call Center at the number listed above.

If any applicant needs additional assistance submitting their application or is experiencing technical difficulties, please reach out to any of our Community Partners:

- Family Promise Union County – 908-289-7300

- Urban League of Union County – 908-351-7200

- United Way of Greater Union County – 908-353-7171

Applicants should be cautious of anyone requesting payment to complete an ERAP application.

If I’ve received assistance from Social Services in the past, can I still apply?

If you have received assistance from County of Union Social Services, you are still eligible to apply for financial assistance, however your ERAP benefit may be reduced to reflect duplicative assistance.

What does the assistance pay for?

The funds are for payment towards your past-due rent, past-due utility bills, if applicable. If your landlord is registered through ERAP, your landlord will receive the payments directly. Past-due electric and gas bills will be handled directly through the utility providers.

If I pay with a housing benefit like in an income restricted affordable housing complex, can I apply for assistance?

Tenants who receive other housing benefits, like Section 8 or other housing vouchers, are eligible for assistance. The Emergency Rental Assistance Program cannot duplicate housing benefits already being provided to residents. The ERAP will only cover the tenant’s required rental contribution and not the federal portion.

If I have a roommate, can we both apply for assistance?

The program will only accept one application per household, including roommates. Roommates should submit one application together with all their supporting documents, including individual tax returns.

Who in the household can apply for assistance?

Only one application per household will be accepted and must be in the name of the person affected by COVID-19.

What if I have a baby but they aren’t included on my lease agreement? Do they count towards my household size?

Eligibility and household size will be based off your lease agreement and/or supporting documents from your landlord, if needed. An eligibility specialist will be able to assist in the determination of household size.

Am I eligible if I meet some, but not all, of the eligibility requirements?

No. You must meet ALL eligibility requirements to be eligible.

How much will I get if I’m approved for assistance?

Once your application is accepted and you are determined eligible, your financial assistance amount for rental assistance will depend on a variety of different variables including when your loss of wages began. Rental assistance payments will be provided directly to your landlord, if your landlord is registered with ERAP. Assistance provided can be up to 12 months of past-due rent from April 1, 2020 or later, per household. It may also cover the current month and prospective month, which is considered on a case-by-case basis if applicable.

For past-due electric or gas assistance, payments will be provided directly to the utility provider and depend on past-due charges that are due at the time of application review and COVID-19 impact date.

If I’m approved for assistance, how long will it take to receive my money?

Every request is unique and processing eligibility and payment time will vary.

Your payment could take several weeks to arrive, but you will be able to track the status of your application online.

Payments will made directly to your landlord if your landlord is registered through ERAP.

What happens if my landlord declines to participate in the program?

Per the Emergency Rental Assistance regulations the landlord must accept the rental assistance. It is a violation of NJ Law Against Discrimination for a landlord not to accept payments as stated below:

The New Jersey Law Against Discrimination (LAD), enforced by the Division on Civil Rights, prohibits discrimination and harassment in housing based on the source of lawful income a tenant uses to pay rent, including the COVID-19 Emergency Rental Assistance Program (CVERAP). That means that a landlord cannot refuse to accept CVERAP, refuse to fill out or send in the paperwork that is required for CVERAP, or threaten or attempt to evict someone because they seek to pay rent with CVERAP. Violating the LAD may subject a landlord to civil penalties of up to $10,000 per violation in addition to money damages to the tenant. Visit this website to find out more about the LAD’s protections for people receiving rental assistance.

Landlords will also be required to sign an agreement upon completion of their owner verification documentation (W9, Direct Deposit, etc.) in which they must agree that they will not evict the tenant for any period of time in which the tenant receives assistance. They must also agree to withdraw any eviction complaint for that period.

If I have applied for assistance but wish to report unsafe living conditions at my residence, what should I do?

If you believe you are experiencing unsafe living conditions your landlord has not resolved – for example, your residence has exposed electrical wiring, water leaking through the ceiling or walls, broken or missing windows, or raw sewage due to broken or malfunctioning plumbing – please call the State of New Jersey Bureau of Housing Inspection at 609-633-6241 or contact your local municipal code enforcement office.