Updated January 21, 2026

▣ Forms

- Tax Related Forms–

- Employee Experience

- Payroll Related

- FSA

- Group Term Line

- Other Forms

▣ Contacts

Payments to Vendors, EPECS, Drawdowns, Operating Accounts, Edmunds Financial System – Office of the Comptroller

- Jason Shanley, Division of the Comptroller Director – 908-527-4051

- Denise Harris, Fiscal Analyst – 908-527-4413

Payroll

- Lily Duran, Payroll Supervisor – 908-527-4088

Trust Accounts

- Laurie Caternicchio – 908-527-4827

- Elizabeth Olivari – 908-527-4000 ext. 2417

Capital Accounts

- John Dziedzic, Division of Internal Audit Director – 908-527-4818

Grants – Division of Reimbursement

- Cathy Campanella, Division of Reimbursement Director – 908-527-4829

Deposits, Petty Cash, Change Funds, Banking, Credit Card Processing matters, Capital/Debt Service

- Julie Origliato, Division of the Treasurer Director – 908-527-4075

Pensions

- Almerinda Henriques, Pension Administrator – 908-527-4058

Edmunds User Request and Training Guides

- Erica Catarella – 908-527-4000 ext. 2367

▣ Newsletter

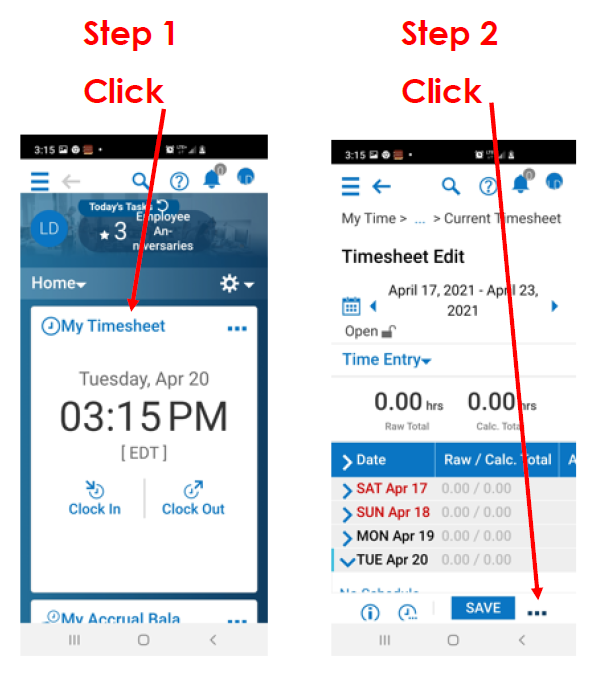

▣ UKG Instructions

Important Notes

- Punches are controlled via GPS and your manager will be able to ensure that you are at approved location.

- Kindly Punch IN/OUT for lunch.

- If you miss a punch you should advise your supervisor via e-mail for record purposes and submit a ‘missed punch’ request using the UKG app. Instructions below.

- When punching in screen may appear greyed out, just touch the screen it should allow you to punch.

Downloading the App on your Mobile Phone

Visit the Apple App Store or the Google Play Store to download the UKG Ready app

Please Note: There are several Kronos apps available, so make sure you click the links above from your phone or choose the app with the exact name as you see above.

The first time you open this app, you will be prompted for the following:

- Region: North America

- Company Shortname: COUNTYOFUNION

- Username: Employee Id Number (including leading zeros) see your stub, call payroll 527-4082 or e-mail Lduran@ucnj.org

- Password: 123456 (unless already changed)

- Once App is on your cell, allow UKG ready to access location services.

You may have to go into your phone settings and ensure your location services is ON.

▣ FSA Money

Don’t Forget Spend your FSA Money

Fax Claim form / Call with Questions:

Horizon Blue Cross Blue Shield of New Jersey

3 Penn Plaza East PP-05S

Newark, NJ 07105-2200

(800) 224-4426

Fax 973-274-2215

▣ Pay Schedule

| Pay # | Pay Date |

|---|---|

| 1 | Thursday, January 15, 2026 |

| 2 | Friday, January 30, 2026 |

| 3 | Friday, February 13, 2026 |

| 4 | Friday, February 27, 2026 |

| 5 | Friday, March 13, 2026 |

| 6 | Monday, March 30, 2026 |

| 7 | Wednesday, April 15, 2026 |

| 8 | Thursday, April 30, 2026 |

| 9 | Friday, May 15, 2026 |

| 10 | Friday, May 29, 2026 |

| 11 | Monday, June 15, 2026 |

| 12 | Tuesday, June 30, 2026 |

| 13 | Wednesday, July 15, 2026 |

| 14 | Thursday, July 30, 2026 |

| 15 | Friday, August 14, 2026 |

| 16 | Friday, August 28, 2026 |

| 17 | Tuesday, September 15, 2026 |

| 18 | Wednesday, September 30, 2026 |

| 19 | Thursday, October 15, 2026 |

| 20 | Friday, October 30, 2026 |

| 21 | Friday, November 13, 2026 |

| 22 | Monday, November 30, 2026 |

| — | Thursday, December 3, 2026 – Stipends & Uniform Allowance (if applicable) |

| 23 | Tuesday, December 15, 2026 |

| 24 | Wednesday, December 30, 2026 |

▣ Retirement Seminars and Webinars

Retirement Seminars and Webinars take a step-by-step approach to the retirement process and explain what happens after you submit your application. We explain your benefits, survivor options, group life insurance, loan repayment provisions, and the taxability of your pension.

There is also a brief discussion of State Health Benefits Program and School Employees’ Health Benefits Program coverage in retirement. If time permits, sessions conclude with a question and answer period.

If you register to attend be sure to do the following:

- Be sure the seminar or webinar you select is for your retirement system (PERS, TPAF, or PFRS)

- You should complete and print an Estimate of Retirement Benefits using the Member Benefits Online System (MBOS) so you can follow along during the presentation. Retirement estimates are not provided at the seminar.

Space is limited, so register today!

▣ Funds Handling & Deposit Procedures

Departments, Offices and Agencies of the County of Union shall obtain written permission from the County Manager and the County Treasurer for all locations that receive monies on behalf of the County of Union. Please file requests prior to the commencement of receiving monies in each calendar year. The terms “funds” and “monies” refers to both cash and checks.

All moneys received from any source by or on behalf of the County of Union shall within 48 hours after receipt be turned over to the Department of Finance, Division of Treasury.

All receipt of funds must be entered in a cash receipt journal.

Duplicate Pre-numbered cash receipts shall be utilized. The original receipt shall be issued to the payer. The receipt copy shall be retained by the Department.

Departments shall maintain a cashier log including the following information: date of collection, receipt number(s), total amount of funds collected, name of the cash handler, name of the depositor, license/permit number, and the date when funds were remitted to the Department of Finance, Division of Treasury.

It is imperative that all receipts are directly traceable to a transmittal and that all transmittals be directly traced to an entry in the cash receipts journal.

The Revenue Deposit template, provided by the Department of Finance, Division of Treasury, shall should be placed on Departmental letterhead and accompany each deposit. The template is sent under separate cover.

The Department of Finance, Division of Treasury is responsible for depositing all funds received into a GUDPA certified depository within 48 hours as outlined in the County of Union’s Cash Management Plan.

Departments should utilize the invoicing module in the Edmunds system to assist in collecting and identifying funds due to the County.

All funds must be properly secured during and after business hours in a locked cash box, preferably a fireproof safe, to prevent loss. Funds are to be secured on County property. Funds are never to be taken home or stored at a private residence or in a motor vehicle.

All cash operations are subject to review by the County of Union’s external auditors and the Department of Finance’s internal auditors. Reviews may be scheduled or unannounced.

Do not put any cash or checks in the inter-office mail. Please drop off to the Treasury Division in person or by County messenger.

▣ Petty Cash

Petty Cash Statement (Microsoft Word format)

Petty Cash is a method to facilitate small claims. It is not an alternative source of funding. Therefore, petty cash cannot be used to circumvent controls or to pay expenses which are to be paid through the normal accounts payable cycle. All Petty Cash Funds are established by the Board of County Commissioners subject to approval by the NJ Director of the Division of Local Government Services.

Use of petty cash funds must conform to requirements for budgetary sufficiency of funds and all other pertinent County controls.

The amount of cash on hand plus expenses not yet reimbursed may not exceed the amount authorized by the Board of County Commissioners.

All expenses must be promptly listed on a purchase order and submitted to the Department of Finance, Division of Comptroller for reimbursement. Purchase Orders must include original invoice(s) for documentation to be reimbursed and must be signed by the custodian of the fund.

Petty cash must be properly secured during and after business hours in a locked cash box, preferably a fireproof safe, to prevent loss. Funds are to be secured on County property. Funds are never to be taken home or stored at a private residence or in a motor vehicle.

The fund must be available during business hours for review by the County of Union’s external auditors and the Department of Finance’s internal auditors – reviews may be scheduled or unannounced.

The following are examples of disallowed petty cash expenses:

- Postage

- Membership Fees

- Registration (Seminar/Conference)

- Meal Allowance

- Lodging

- Travel (e.g. Parking, Tolls and Gasoline)

- Gift Cards

- Office Parties

- Holiday Decorations

- Mileage Reimbursement

Some extraordinary circumstance may occur which may require use of petty cash for the cited disallowable expenses. Custodian must submit a memorandum detailing the extraordinary circumstance, with appropriate back-up, when submitting petty cash reimbursement.

No other cash or refunds are to be commingled with petty cash. Refunds of expenses must be forwarded to the Department of Finance, Division of Treasury with indication of the account to which these refunds should be credited.

All petty cash expenses must be charged to an appropriate sub account in each Department’s Budget. This is to be accomplished by listing the accounts on the Purchase Order submitted to the Department of Finance, Division of Comptroller for reimbursement.

All petty cash funds must be closed at year end. At that time all cash in the fund must be remitted to the Finance Department, Division of Treasury. In addition, all expenses must be forwarded to the Department of Finance in Purchase Order form. For any Purchase Order already submitted but unpaid, a photocopy of the purchase order must be forwarded along with the cash. The total of the cash and the Purchase Order must equal the amount of the fund. In addition, a statement must accompany the funds stating the fund is closed and that all funds are accounted for. Copies of this statement will be issued for your use at year end. See the attached Petty Cash Statement Form.

Custodians of Petty Cash Funds are designated by resolution of the Board of County Commissioners and are responsible for ensuring that the above procedures are followed.

Any changes to the Petty Cash Fund, such as increases, purpose of the fund or change in Custodian must be authorized by resolution and approved by the NJ Director of the Division of Local Government Services.

At the end of each calendar year, the Custodians shall return any remaining cash and process a final close-out Purchase Order, signed by the Custodian. Additionally, the Custodian needs to sign the Petty Cash Statement form that is submitted at the end of the year.

▣ Change Fund

A Change Fund is established to make change at various County service locations involving cash transactions.

Change Funds are NOT to be used for petty cash purposes or reimbursement of expenditures.

Change Funds shall not be commingled with revenue collected by or on behalf of the County.

Change Funds must be properly secured during and after business hours in a locked cash box, preferably a fireproof safe, to prevent loss. Funds are to be secured on County property. Funds are never to be taken home or stored at a private residence or in a motor vehicle.

The fund must be available during business hours for review by the County of Union’s external auditors and the Department of Finance’s internal auditors – reviews may be scheduled or unannounced.

Change Funds must always equal the amount authorized by the Board of County Commissioners.

Custodians of Change Funds are designated by resolution of the Board of County Commissioners and are responsible for ensuring that the above procedures are followed.

▣ Encumbering Contracts/Commitments

Encumbering funds appropriated at the time contracts or commitments are authorized ensures that the funds allocated for such purposes are reserved and cannot be used for other charges within that line item.

Departments shall encumber amounts appropriated for “Other Expenses” by entering a requisition in the Edmunds Financial System simultaneous to requesting the Board of County Commissioners adopt a resolution approving a contract for goods and services.

The requisition number shall be entered into the Financial Impact Section of Minutetraq. Resolution requests not accompanied with the requisition number will not receive a certification of availability of funds.

Upon adoption of a resolution by the Board of County Commissioners, a Purchase Order for goods and services can be issued if all approvals are granted on the

Departmental level and meets the approval of the Division of Purchasing.

EXCEPTION – While operating on a Temporary Budget, Departments shall encumber a pro-rated share of contracts/commitments to reflect the temporary appropriations so authorized in the Edmunds Financial System. Upon adoption of the CY Budget, Departments shall fully encumber the contract/commitment. Please Note: The Financial Impact Section of Minutetraq should always reflect the full contract value.

If a purchase or the execution of a contract does not require adoption of a resolution of the Board of County Commissioners, then the individual requesting a purchase shall obtain a duly authorized Purchase Order prior to placing an order for goods and services.

Attached for reference is a guide on Purchase Order Requirements; however, please refer to the County’s Purchasing Manual for full guidance on purchasing procedures via the UC Employee Intranet.

▣ Drawdown on Existing Purchase Orders

All Departments, Offices and Agencies of County Government shall utilize the Edmunds Financial System to drawdown on Open Purchase Orders instead of submitting typed vouchers. Utilizing the Edmunds Financial System for all purchases ensures that the Department Head and the Department of Finance approves of partial drawdowns for additional goods and/or services while simultaneously insuring that adequate balances exist on open Purchase Orders.

Drawdowns from open Purchase Orders can be effectuated by the following process:

- Log into Edmunds Financial System

- Go to: Finance>A/P> Purchase Requisition>Requisition Maintenance

- Click Add. The next available requisition number will default. Click Ok.

- Complete Vendor, Description and Shipping Information.

- P.O. Type: Menu options are New Blanket or Existing Blanket. Select Existing Blanket. Click Save.

- Click Line Item on Requisition Maintenance Screen. The Requisition Line Item Maintenance Screen will appear. Enter detailed Line Item Descriptions, Account Number, Unit Price, Quantity and Invoice Sections.

- All initial quotes/invoices should be attached to the requisition prior to first approval. These attachments should have a unique name to their respective document (i.e. Invoice #123 October 2024 Payment)

- The description for each drawdown should be the DD# followed by good/service. For example, “DD #1 January”.

Note: Information entered into the Invoice field will appear on Accounts Payable Checks. The above process remains the same for stand-alone Purchases with the exception that the P.O. Type should be left blank for “one time/normal requests.”

*** To alleviate potential delays in acquiring goods and services previously authorized under an Open Purchase Order, Department/Divisions may with the approval of their Department Head place the order after entering the requisition in the system and receiving all requisition level approvals. Please Note: This exception only exists for drawdowns on open purchase orders.

▣ Payment of Moneys

The Department of Finance processes accounts payable checks weekly. Checks are released only to the payee by mail.

No bill, demand or claim shall be paid unless a detailed statement of the terms or demands is provided, specifying particularly how the bill or demand is made up, as well as a certification of the party claiming payment that it is correct. Nor shall any bill, claim or demand be paid unless the Purchase Order on which it is presented carries a certification of the Head of the Department, Office or Agency, and another, duly designated departmental representative having personal knowledge of the facts that the goods have been received by or the services rendered to, the County.

Departments shall update their list of authorized signatories with the Department of Finance, Division of Comptroller prior to the beginning of each calendar year and as changes in signatories occur.

Prior to forwarding Purchase Orders with corresponding back-up for payment, Departments are responsible for the following:

- In consultation with the Department of Administrative Services, Division of Purchasing all Purchase Order requirements are met based upon aggregate pricing thresholds. See Attached.

- Checking pricing on the bill, demand or claim against the authorized Purchase Order to insure same is reflected in the approved contract.

- Checking the math on the bill, demand or claim to insure totals are accurate.

- Vendor name and information on the bill, demand or claim corresponds to the information on the Purchase Order.

- Three signatures appear on the Purchase Order. (All three signatures must be from different individuals):

- Head of the Department, Office or Agency,

- Another duly designated departmental representative, and

- Vendor.

- Budget appropriation accounts charged for goods and/or services shall correspond to the budget year in which goods and/or services are required. (i.e. Departments cannot charge a CY23 account for CY24 activity).

- A duly authorized Purchase Order preceded an order for goods and/or services.

Advance payment for goods/services is generally prohibited. An allowable statutory exception exists for advance payment to nonprofit organizations or agencies with which the County enters into a service contract, if the following criteria are met:

- The source of funds advanced is a Federal grant allowing the County to receive funds in advance of disbursement and requiring that any interest earned on said funds shall be returned to the Federal Government.

- The Board of County Commissioners adopts a resolution authorizing the advance and that the purpose of the advance is to meet service program start-up costs and prevent an undue hardship to the nonprofit organization or agency in achieving the objectives of the Federal grant.

- The amount of the advance to any given nonprofit organization or agency does not exceed an amount equal to the total amount of the contract with the nonprofit divided by the number of months in the term of the contract. Further, the total disbursements including the amount of the advance outstanding shall not at any time exceed the total cash receipts of the County under the Federal grant up to that time.

- The resolution authorizing the advance includes a schedule for the depletion of the advance and indicates that the advance will be entirely depleted by the termination date of the contract.

The use of gift cards and prepaid cards for the payment of goods/services at a later date is prohibited.

County funds are to be expended for purposes essential to transacting official County business. As such, reimbursement or expenditure of public funds for departmental/division holiday luncheons or dinners is not permitted.

The aforementioned does not prohibit reimbursement for the cost of an official luncheon or dinner for which an employee is given authorization by the Department Head, via EPECs, when such a meal is scheduled as part of an official proceeding or program related to County business and the employee’s responsibilities.

▣ Payment in Advance for Travel Expenses

All payment of advanced travel expenses will be made directly to the vendor via purchase orders only.

EPEC forms must be attached to the purchase order. Purchase orders will not be processed for payment if properly completed EPEC forms are not attached.

The payment of advanced travel expenses are limited to the following:

- Conference, seminar and webinar registrations

- Hotel reservations

- Airfare and train fare reservations

Each department will designate an employee who will be responsible for the verification and adjustment of advanced payments made for officers/employees in that department. That designated employee must obtain the following from the officers/employees within 10 days after the completion of the travel for which an advance was made, and forward a copy of same to the Division of Comptroller:

- Detailed bill of items

- Affidavit from the officers/employees (see page S-15 of this manual).

The Department of Finance has a Notary available if needed.

▣ Policies and Procedures for the use of Store Charge Card/House Account Cards

A store charge card/house account card means an account, linked to a store charge card/house account card issued by a specific vendor, for which goods and services may be charged and that must be paid when a statement/invoice is issued. The store charge card/house account card issued by a specific vendor can only be utilized for the goods provided by said vendor and may be regulated by certain restrictions.

Store charge card/house account cards are a method to facilitate small claims and are not an alternative source of funding. Therefore, store charge card/house account cards cannot be used to circumvent controls or to pay expenses which are to be paid through the normal accounts payable cycle.

A maximum of 2 cards per account may be utilized per account. One card must be held by the Department/Division head and one card by an employee designated by the Department/Division Head. These store charge card/house account cards are non-transferable to any other employees.

The use of a store charge card/house account card is subject to approval by the Department of Finance. Requests submitted to the Finance Department shall include the following:

- Reason for the use of a store charge card/house account card

- Name of the vendor issuing the store charge card/house account card

- The type of purchase that will be made (for County related purposes only). The collective store charge card/house account card limit being requested on all the store charge card/house account cards that will be issued shall not exceed $2,000.

- Names of the employees who will be issued a store charge card/house account card (Max 2 issued)

- Name of the store charge card/house account card Department/Division heads who will monitor the use the store charge card/house account cards, (Department/Division Head Monitor)

- Store charge card/house account cards can only be used for official County of Union business. The personal use of a store charge card/house account card is not allowed.

The following store charge card/house account card procedures must be followed by departments permitted to use store charge card/house account cards:

- Provide to the Department of Finance the original signed vendor store charge card/house account card approval documentation. The department will also provide copies, (both front & back), of the store charge card/house account cards issued to the department’s employees.

- Provide to the Department of Finance signed affidavits from employees issued store charge card/house account cards acknowledging that they understand the store charge card/house account card procedures and that they are responsible for all transactions which occur on the store charge card/house account card issued to them.

- Create an open Purchase Order encumbering the allowed/approved collective store charge card/house account card limit amount. Drawdowns will be made against the open Purchase Order for statements/invoices submitted by the vendor. A new open Purchase Order encumbering the same amount will be created after the existing open Purchase Order has been fully drawn down.

- Employees assigned store charge card/house account cards must obtain written pre-approval, (e.g. via email), from the Department/Division Head Monitor, prior to making a purchase. A copy of written approval must also be sent to Jason Shanley in the Department of Finance.

- All purchases should generate an immediate email to the Department/Division head.

- Receipts generated from the purchase transaction must be provided to the store charge card/house account card Department/Division Head Monitor. The store charge card/house account card Department/Division Head Monitor will obtain statements/invoices from the vendor.

- The store charge card/house account cards Department/Division Head Monitor will reconcile the receipts to the vendor statements/invoices. Both items will be initialed and dated by the Department/Division Head Monitor for approval.

- A drawdown Purchase Order will be generated for the approved receipts and invoices. After all the receipts and invoices have been attached to the drawdown Purchase Order, authorized signatures must be obtained. The complete drawdown Purchase Order package will be submitted to the Department of Finance – Accounts Payable for review and payment.

- All outstanding balances must be paid in full each month.

▣ Special Items of Revenue/Grants

Prior to including Special Items of Revenue/Grants in the Budget and forwarding same to the Division of Local Government Services (through the Temporary Budget, Amendment to the Temporary Budget, Budget Adoption or Chapter 159), Departments shall complete a Special Item of Revenue/Grant Budget Insertion Request Form on the UC Grants program to insure uniform information is obtained and maintained for Audit purposes. Please refer to the attached Special Item of Revenue/Grant Budget Insertion Request Form as a guide to the information to be recorded on the program.

In the process of administering grant programs, Departments are reminded of the following:

- Fiscal reports should reflect reconciled costs which compare salary allocations to actual time spent on grant activities. A standard percentage of an employee’s salary cannot be used to allocate costs. Employees should be made aware of their allocation and coordinate with the department’s payroll liaison for allocations changes due to reconciled costs.

- Reconciled time sheets must be filed monthly with the Department of Finance, Division of Reimbursement.

- The Department/Division that applied and accepted the grant award must follow federal and/or state grant guidelines, statutory and regulatory requirements and policies. All obligations must be encumbered within the grant period, and liquidation of obligations must be within the closeout period of the grant.

- All fiscal reports filed with a State/Federal Agency for reimbursement must also be filed simultaneously with the Department of Finance, Division of Reimbursement for auditing purposes.

- All Monitoring and/or Audit reports issued by the grantor and Corrective Action plans must be forwarded to the Division of Reimbursement for auditing purposes.

- The Department of Finance, Division of Reimbursement must be notified of employees charged to a grant whose personal leave is greater than 5 or more consecutive business days. The salary allocation may need to be adjusted to stay compliant with State/Federal guidelines.

▣ Privately Owned Vehicle (POV) Mileage Reimbursement Rates

Prior to an employee using a privately owned vehicle for work related travel, an employee must first request the use of a County pool car. A pool car approval form must be submitted to the Department of Administrative Services. If a pool car is not available, then an employee can use a privately owned vehicle and submit for mileage reimbursement. A copy of the pool car approval form, showing that a pool car was not available at the time of travel, must be included with the mileage reimbursement form in order to get reimbursed.

The IRS has adjusted all POV mileage reimbursement rates effective January 1, 2024. If use of a privately owned vehicle is authorized and if no County owned vehicle is available, the rate per mile reimbursed is $0.67 or as detailed in each applicable collective bargaining agreement.

Employees must calculate reimbursable mileage based on the shortest and most cost- effective route between two destinations. This is the case even if the employee chooses another route. Commuting to and from work is not reimbursable. This is considered commuter mileage rather than business mileage.

The only two destinations should be the office site where the employee is regularly assigned and the temporary work related destination site. If an employee travels from home to the temporary work related destination site, reimbursement shall be on the basis of total travel costs from home to the temporary work related destination site or from the office site to the temporary work related destination site, whichever is less.

To receive mileage reimbursement, employees must maintain a log of their business miles, and a copy of this information must be supplied to their Department. The log must include the date of the trip, the mileage driven and the reason for the travel. See the attached Mileage Reimbursement Request Log.

Original receipts of tolls paid during business travel must accompany the log and shall serve as back-up to Purchase Orders.

Employees will receive reimbursement for miles traveled and tolls only when the business travel was approved in advance by their Department Director and no County owned vehicle was available for use.

Mileage reimbursements for the year 2024 must be submitted before year end. Any mileage reimbursements submitted in year 2025 for travel that occurred in 2024 will not be approved for reimbursement.

▣ Access to the Edmunds Financial System

Departments, Offices and Agencies of County Government are asked to complete the Access/Authorization to Edmunds Financial System Form to insure that only authorized users have access to the financial system.

Please complete the Edmunds Financial System Access Form for each authorized user and return to the Department of Finance Attention: Erica Catarella. Current users not authorized by the Head of their Department, Office or Agency will cease to have access to Edmunds. See the attached Access/Authorization to Edmunds Financial System Form above.

User ID for Edmunds Financial System

The Edmunds Financial System User ID assigned to an employee can only be used by that employee. Using another employees User ID to create or approve Requisitions is not permitted.

▣ Payroll Processing

Payroll is processed on a semi monthly basis on the 15th and 30th of each month. Time is gathered at department level week by week.

Payroll Liaisons have access to Primepoint where they can create worksheets as well as view and check reports for their departments only.

Payroll Liaisons process the employees time using one of 2 methods:

- Primepoint Grids: Primepoint worksheets have all the pay categories necessary, and the payroll Liaison can enter all the employee hours or amounts into their department worksheet. This applies to County of Union salaried employees.

- Time clock external file import: Jail, Sheriff’s and Hospital have time clocks. These time clocks prepare a file that is placed into a designated network file. The payroll Supervisor imports the file into Primepoint. This applies to County of Union hourly employees.

Once all the time is on worksheets and time imports are complete the Payroll Department will process a preliminary payroll.

Primepoint users can extract Primepoint Reports to review payroll.

Preliminary payrolls can be run as many times as possible until payroll is as error proof as possible.

After the final payroll is processed all departments can run their own payroll reports to view it.

The Finance Department receives checks and direct deposit stubs via FedEx the next day after the final run is processed. These checks are counted, sorted and distributed to the County’s payroll liaisons. The payroll liaisons will distribute the checks to the employees in their department.

▣ Mobile Check Deposit Procedures

Employees are recommended to use the following guidelines when depositing paychecks via mobile deposit APP.

- Upon scanning and completing a mobile deposit, write “electronically presented on (date)” across the top of the check to protect against duplicate deposits.

- Securely store the check for 30 days after it has been posted to your account. After 30 days, you can consider the check to be void and securely destroy it.

Should a payee attempt to physically deposit a check that has already been deposited electronically, the payee will be responsible for reimbursing the financial institution or check cashing store for the duplicate presentment of the check.

▣ Capital Requests and Spending

Capital requests are submitted to the Department of Finance beginning each Fall of every calendar year for the next calendar year during the annual budget process.

Capital requests should be items that have a useful life of at least five years. Some examples are:

- Road resurfacing

- Computers/technology equipment

- Furniture and Equipment

- Infrastructure improvements

- SUV’s and trucks (passenger cars and station wagons are not considered capital)

- Environmental remediation that is part of a larger capital project (i.e. remediation on the removal of underground tanks). However, a sample air test in a building just for the sake of testing is not considered a long-term capital project. This would be a short term test (sample) and would not be permissible to charge capital funds for this purpose.

When using capital funds for a purchase, a capital request form should be submitted to the County Manager’s office for approval prior to a requisition becoming a purchase order. Once the Department has the authorization form signed, it should be attached to requisition(s) in the financial system so that Finance can review for determining account usage. Once reviewed, Finance will give 1st approval if the proposed capital account matches the purpose of the purchase and there is sufficiency of funds. The requesting Department will complete 2nd approval. Purchasing will complete 3rd approvals for new blankets and one-time payments. Finance will complete 3rd approvals for drawdowns.

Please note: If a capital account was adopted with an ordinance description for computers, you cannot use this account to buy any other type of item (i.e. fencing, roof repairs, etc.)

Although the Capital Budget is included with the County’s annual adopted budget, the capital accounts and budget do not become effective until a Capital ordinance is adopted sometime after the annual County Budget.

Finance will assign account numbers for new capital accounts and distribute to the respective departments once the ordinance takes effect (usually 20 days after the adoption date).

▣ Credit Card Sales/Receipts Handling Procedures

Purpose

This policy sets forth requirements to be followed by employees and provides guidance for compliance with industry standards for credit card processing.

Policy Statement

The establishment of control measures for credit card sales/receipts transactions is necessary to maintain proper security over credit cardholder information. The Division of the Treasurer requires each location (i.e. Constitutional office, Department or Division) be approved and set up as a credit card processing merchant with the ability to use each method of processing credit transactions.

Requirements for Credit Card Processing Include the Following

- Finance, County Counsel and Purchasing approval before entering into any contracts or purchases of credit card processing software and/or equipment. This requirement applies regardless of the transaction method or technology used (i.e. e- commerce or point-of-sale device).

- Comply with procedures for safeguarding cardholder information and secure storage of data. This pertains to ALL transactions (over the counter or online).

- Complete an annual security self-assessment questionnaire provided by Security Metrics or a comparable merchant data security and compliance company.

- Compliance with Payment Card Industry (PCI) Data Security Standards.

Who Should Know This Policy

Any management with responsibilities for utilizing Union County credit card transactions, and those employees who are entrusted with handling credit cards and credit card information must be familiar with, understand, and comply with this policy.

Responsibilities of the Department of Finance – Division of Treasurer

- Review and approve the establishment of new department (or additional) credit card accounts and/or processors.

- Administer the process of obtaining new Merchant I.D. numbers.

- Conduct periodic reviews of existing departments regarding safeguarding and storage of cardholder information.

- Collaborate with the Division of Information Technology to complete the annual security self-assessment questionnaire.

Responsibilities of Departments and Offices using Credit Card Sales

Departments and Constitutional Offices submit a request to establish credit card accounts with an approved merchant service provider. Credit Card Handling Supervisor (Management) ensures the following standards are maintained:

- Keep secure and confidential all cardholder information. Credit card receipts should typically be treated the same as you would treat cash.

- Ensure the Department/Constitutional office does not store or retain credit card numbers after processing.

- Ensure credit card transactions are only conducted on secure computers or other authorized devices. A quarterly scan will be conducted by Security Metrics to ensure the network is non-compromised.

- Sensitive cardholder data (i.e. full account number, type, expiration, and track (CVC2/CVV2) data, CANNOT be stored in any fashion (paper, computers or networks, etc.).

- Credit card numbers must NOT be transmitted in an unsecure manner, such as by e-mail, fax or traditional mail.

- Credit card receipts should be kept in secure environments such as locked drawers, file cabinets in locked offices, locked storage facilities, and safes.

Restrict Access to Credit Card Data and Processing to Appropriate and Authorized Personnel

- Maintain an updated list of authorized credit card processing personnel, authorized computers or other media (wireless hand held units, third party gateways, etc.)

- Establish appropriate segregation of duties between credit card processing, the processing of refunds, and the reconciliation function.

- Perform an annual self-assessment to ensure compliance with this policy and associated procedures and report results to the Division of Treasury.

Accounting for Sales/Receipts Transactions

The daily sales settle electronically into the appropriate bank account, usually within 48 hours. It is the responsibility of the Department/Constitutional Office to close out credit card batches daily.

It is the Department’s responsibility, in cooperation with Finance, to reconcile the settlement amount in the general ledger account to the credit card receipts on a regular basis, but no less than monthly.

Each Department receives a monthly statement directly from the merchant service provider. These statements provide a listing of each batch submitted for reconciliation purposes. It is each Department’s responsibility to verify that this information is correct. If the Department is not receiving such statements, please contact the Division of the Treasurer.

Additional Information

- Fees – each transaction is subject to interchange, discount and per item fees charged by Visa, MasterCard, Discover and American Express. Additional fees may be assessed by the authorized merchant service provider based on the RFP process. Examples include monthly maintenance fees and chargeback fees.

- Merchant Service Provider – The current processing provider for the County of Union is TD Merchant Services (First Data). See Resolution #940-2015 adopted December 3, 2015.

- CODE 10/Fraud – Should personnel suspect credit card fraud from a customer, the Code 10 phone number to call is 800-228-1122 option 4. Personnel should simply say they have a Code 10.

▣ Miscellaneous

If you are interested in further training on any of the above matters, please contact the respective Finance Division to coordinate a time to meet or speak further.