Union County Senior Emergency Home Repair Grant Program

• Pre-Application

Please submit this pre-application to get started. After submitting, please review and start gathering the applicable documents listed below. It will also be e-mailed to you.

• Income Eligibility Requirements

Maximum Income Limits: (total gross a year)

- 1 Person – $72,950

- 2 Person – $83,400

- 3 Person – $93,800

- 4 Person – $104,200

- 5 Person – $112,550

- 6 Person – $120,900

- 7 Person – $129,250

- 8 Person – $137,550

Click here to Review the Documents Checklist

• Questions

Please contact our grant administrator:

Development Directions LLC

732-382-8100

• Pre-Application

• Document Checklist

English

🖨️ Print this

You will be required to submit the following documents once you go thru the pre-application process.

All household members and all property owners must provide their documents whether they reside in the house or not specifically as listed.

They must also be present for the interview and sign all documents. Note: Please send copies of all documents. Only notarized statements must be original.

- Social Security Cards for all property owners whether they reside in the house or not.

- Verification of all household income which applies to you and your household for any individual 18 years or older and any individuals listed on the Deed whether they reside in the house or not. If you answer yes, appropriate documentation will be needed.

- Four (4) Current Consecutive Paystubs, if there is no income for any individual an original notarized statement stating that will be needed

- Two (2) Current Pension Paystubs or a letter from the company issuing the benefit

- Four (4) Current Unemployment Stubs

- Child Support court documents

- Alimony court documents

- Current Year Social Security Benefit Letter (not the 1099) for ANY individual receiving benefits (SSI, SSD, SS)

- This can be obtained by calling 1-800-772-1213, if you do not have this letter

- Most Recent Full Federal and State Tax Return

- if anyone does not file, an original notarized statement stating what years were not filed will be needed

- Two (2) Current Consecutive months of ALL Full Bank Statements, securities, dividends, etc.

- Recorded Deed to the Property

- a death certificate will be needed for any deceased individual whose name is on the Deed)

- Current Homeowners Insurance DECLARATION Page

- Current Mortgage Statement

- this will be needed again before the contract to start work is signed)

- Power of Attorney (if applicable)

- If you have filed for Bankruptcy in the past 7 years, provide proof that the property was not included.

En español

Deberá presentar los siguientes documentos una vez que complete el proceso de presolicitud.

Todos los miembros del hogar y todos los propietarios deben proporcionar sus documentos, independientemente de si residen en la vivienda o no, según lo indicado específicamente.

También deben estar presentes en la entrevista y firmar todos los documentos. Nota: Envíe copias de todos los documentos. Solo las declaraciones notariadas deben ser originales.

• Tarjetas de Seguro Social de todos los propietarios, residan o no en la vivienda.

• Verificación de todos los ingresos familiares que correspondan a usted y a su hogar, tanto para cualquier persona mayor de 18 años como para cualquier persona que figure en la escritura, residan o no en la vivienda. Si su respuesta es afirmativa, se requerirá la documentación correspondiente.

• Cuatro (4) comprobantes de pago consecutivos y actuales. Si no hay ingresos, se requerirá una declaración notariada original que lo indique.

• Dos (2) comprobantes de pago de pensión actuales o una carta de la empresa que emite el beneficio.

• Cuatro (4) comprobantes de desempleo actuales.

• Documentos judiciales de manutención infantil.

• Documentos judiciales de pensión alimenticia.

• Carta de beneficios del Seguro Social del año actual (no el formulario 1099) para CUALQUIER persona que reciba beneficios (SSI, SSD, SS).

Si no tiene esta carta, puede obtenerla llamando al 1-800-772-1213.

• Declaración de impuestos federales y estatales completa más reciente.

Si no presenta la declaración, se requerirá una declaración notariada original que indique los años en que no la presentó.

• Dos (2) meses consecutivos y actuales de todos los Estados de Cuenta Bancarios completos, valores, dividendos, etc.

• Escritura de propiedad registrada.

Se requerirá un certificado de defunción para cualquier persona fallecida cuyo nombre figure en la escritura.

• Página de DECLARACIÓN del Seguro de Vivienda Actual

• Estado de Cuenta de la Hipoteca actual

(Esto será necesario nuevamente antes de firmar el contrato para comenzar las obras)

• Poder Notarial (si corresponde)

• Si se declaró en Bancarrota en los últimos 7 años, proporcione prueba de que la propiedad no estaba incluida.

• Press Release

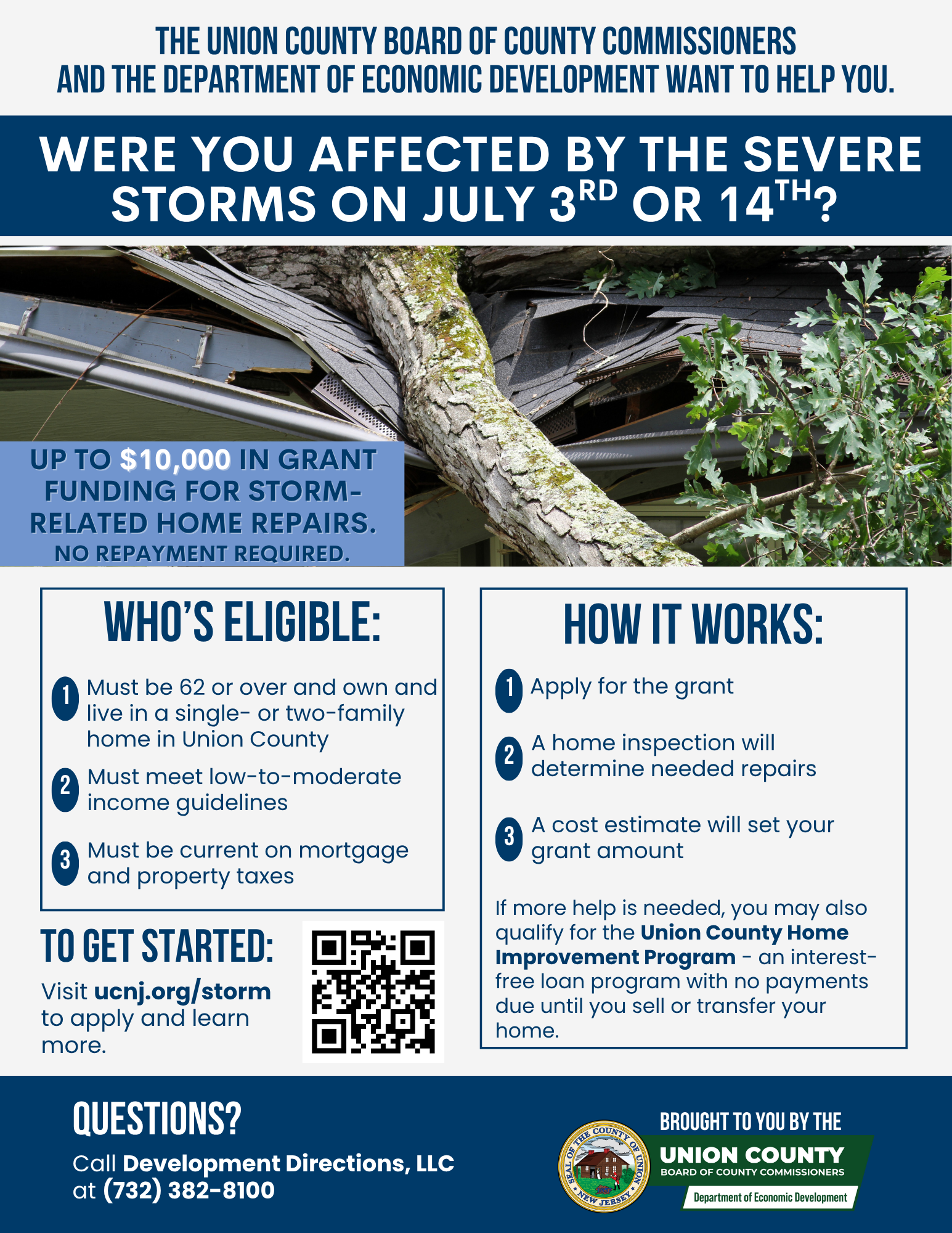

The Union County Board of County Commissioners is launching the Storm-Related Emergency Home Repair Grant Program to assist senior homeowners affected by the severe storms that hit the region on July 3rd and July 14th.

This grant is available to Union County residents aged 62 and older who own and occupy a single- or two-family home that sustained damage from the recent storms. Eligible low- to moderate-income homeowners can receive up to $10,000 in funding to help cover necessary repairs—and the grant does not need to be repaid.

“After such devastating weather events, it’s vital that our seniors feel safe and supported in their own homes,” said Commissioner Chairwoman Lourdes M. Leon. “This program is a direct investment in their recovery and in the stability of our communities. We want to make sure no one is left behind.”

To qualify, homeowners must be current on their mortgage and property taxes. Once an application is submitted, an inspection will be conducted to determine the scope of repairs needed, and a cost estimate will be prepared to establish the grant amount.

For homeowners who may need additional support beyond the $10,000 grant, Union County also offers the Home Improvement Program, which provides interest-free loans with no repayment required until the property is sold or transferred. This program is available to all income-eligible residents, regardless of age.