Welcome to the Office of Veteran’s Services for Union County New Jersey. We offer many resources here for veterans of all ages. The office is here to partner with veterans and their family members and to act as their representative/liaison to help navigate the complicated workings of the Veterans Administration (VA.) Throughout the website you will find links to state, federal & county agencies that you may find helpful. If you have question or concern, please feel free to reach out to us.

Coordinator: W. Geoff Smith 908-527-4918

E-mail Address: W.Geoff.Smith@ucnj.org

Fax: 908-352-3980

Monday thru Friday – 8:30 am to 4:30 pm

Walk-in appointments not accepted at this time.

10 Elizabethtown Plaza

Administration Building, Elizabeth, NJ 07207

VA Crisis Hotline: Website 1-800-273-8255 (24/7)

The VSO provides information and assistance:

- Provides eligibility criteria for all veteran benefits and entitlements.

- Assists in securing copies of lost military documents, such as the DD-214 (military separation document).

- Guides applications for service connected compensation and pension claims.

- Assistances for veteran widows/widowers and children who are applying for benefits.

- Aids with appeals for claims that have been denied.

- Provides death and burial benefit information.

- Directs annual Memorial Day flag placement on veteran graves throughout Union County.

- Information and referrals to other county, state and federal government services, including housing; mental health; education; job training and placement; financial; and medical/nursing home services.

- Facilitates transportation (wheel chair equipped) to the VA Healthcare System at Lyons and East Orange through the Union County Paratransit system.

- Issues Veteran Parking Placards for use in Union County.

- Maintains a data base of local Union County veterans.

- Produces mixers, breakfasts, educational events, and clinics.

Veteran Placard Application

In honor of Veterans, 14 locations in Union County offer designated parking spaces for military veterans, including nine Union County parks and buildings, and five locations in Rahway and New Providence.

The parking spaces feature signage noting their veteran designation, and may be used by any veteran with a car displaying a special placard provided by the Office of the Union County Office of Veteran Services.

- Archery Range at Oak Ridge Park – 136 Oak Ridge Road, Clark

- Ash Brook Golf Course – 1210 Raritan Road, Scotch Plains

- Colleen Frasier Building – 300 North Avenue East, Westfield

- Echo Lake (9/11 Memorial) – 1028 Springfield Avenue, Mountainside

- Galloping Hill Golf Course – 3 Golf Drive, Kenilworth – 2 Spots

- Hamilton Stage – 360 Hamilton Street, Rahway – 2 Spots

- New Providence Borough Hall – 360 Elkwood Avenue, New Providence – 2 Spots

- Rahway City Hall Parking Lot – 1 City Hall Plaza, Rahway

- Rahway Public Library – 2 City Hall Plaza, Rahway

- Rahway River Park (Memorial Grove Area) – St. Georges Avenue, Rahway

- Rahway Senior Citizens Center – 1306 Esterbrook Ave, Rahway

- Trailside Nature and Science Center – 452 New Providence Road, Mountainside

- Union County Administration Building – 10 Elizabethtown Plaza, Elizabeth

- Warinanco Sports Center – 1 Park Drive, Roselle

The Veterans Bulletin

The Official Newsletter of the Union County Veteran Services Office

Join our Veterans Mailing List

Who is Eligible for VA Benefits?

Many New Jersey Veterans are unaware of the numerous federal, state and local program benefits, entitlements and services that are available to them.

You must meet one of the following categories below to qualify for benefits

- An active duty service member

- A veteran (without a dishonorable discharge)

- A veteran’s dependent

- A surviving spouse, child of deceased or disabled veteran

- A parent of deceased veteran

Disabled Veteran, Purple Heart Recipient Placards

- New Jersey law (N.J.S.A. 39:4-207.10) permits exemption from payment of municipal parking meter fees, for up to 24 hours, for disabled veterans and Purple Heart recipients under certain, specific circumstances:

- The parked vehicle is owned by the disabled veteran or the Purple Heart recipient.

- The disabled veteran or Purple Heart recipient is the driver or a passenger in that vehicle.

- The vehicle displays a unique placard issued by the MVC.

- A disabled veteran or Purple Heart recipient placard affords the vehicle owner the same privileges as the license plates.

- An applicant for a placard must be the owner of the vehicle in which the placard is to be used, and the placard can only be used by the owner if that owner is the driver of the vehicle or a passenger in it.

- To receive such a placard, applicants must submit BOTH of the following:

- Proof of disabled veteran or Purple Heart recipient status (DD-214, DD-215, award of disability letter, citation awarding Purple Heart, etc.) and,

- An application (MVC form BA-49).

- Application is available at any MVC agency, by mail, or by calling (609) 292-6500.

- Placards are available at any MVC agency or by mail.

- In person, submit proof of status and a completed, signed application (BA-49), or

- By mail, send photocopy of proof of status and a completed, signed application (BA-49) to:

- NJMVC

- Special Plates Unit

- P. O. Box 015

- Trenton, NJ 08666-015

- Placards are subject to renewal/recertification every 3 years.

- Placards clearly show their expiration date, which will be on the last day of the month that is punched out. The year of expiration will also be punched out.

- The holder of a disabled veteran or Purple Heart recipient placard can also be issued a Person with a Disability (PWAD) placard, if eligible. These unique placards do not replace a PWAD placard.

- The disabled veteran or Purple Heart recipient placard cannot be used for parking in PWAD labeled parking spots.

- Applicants who meet the requirements for both a disabled veteran and Purple Heart recipient placard must decide which type of unique placard – DV or PH – they wish to receive. Only one type of these unique placards can be issued.

- The holder of a unique placard will be issued a placard recipient identification card that will match the owner information on the vehicle registration card for the vehicle in use.

- This specific identification card indicates the actual person who is entitled to use the privilege of the unique placard.

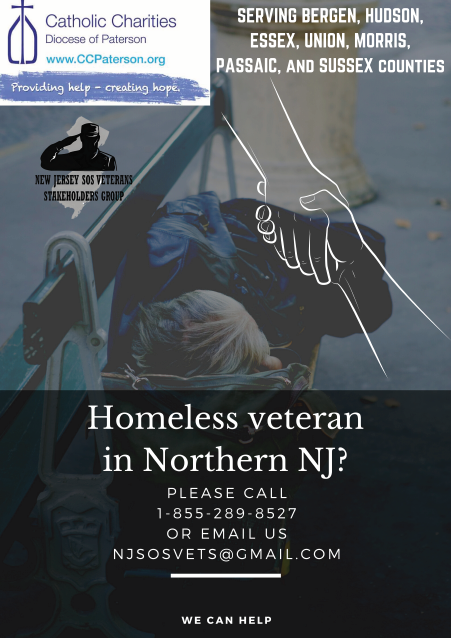

Homeless Veteran Assistance

VA Home Loan

The program provides a guaranty for mortgage loans made by private lenders to eligible Veterans. The guaranty backing effectively eliminates the need for a down payment, helping Veterans afford homeownership.

The VA Home Loan program benefit is not a one-time benefit– it’s reusable.

In addition, VA stands ready to assist Veterans who have already obtained a VA home loan. If you already have a VA loan and are facing financial difficulty, please call to speak to VA loan representatives at 877-827-3702. In FY16, of all loans that defaulted, 84% were saved from foreclosure.

Social Security Administration

Members of the United States armed forces receive expedited processing of their Social Security disability applications.

Military service members are covered for the same Social Security survivors, disability, and retirement benefits as everyone else. Although the expedited service is relatively new, military personnel have been covered under Social Security since 1957, and people who were in the service prior to that may be able to get special credit for some of their service.

Special Extra Earnings for Military Service

Office of the Union County Clerk

- Veteran Discounts

- Identification / Licenses / Voter Registration

- Honorable Discharge Identification Cards

- Military Discharges

- Veterans’ Peddlers Licenses

- Vote by Mail for the Military

Learn more at ucnj.org/ctyclerk or by calling 908-527-4787

Federal ID Cards

Disability Compensation

Service-connected disability compensation is a tax-free benefit paid to Veterans for a disability (or disabilities) that either:

- Arose during service

- Was worsened or aggravated by service

- Is presumed by VA to be related to military service.

To receive disability compensation, you must have been discharged under other than dishonorable conditions.

Transportation for Veterans

Union County Paratransit offers transportation for Union County’s veterans at a fee of $3.00 for a one-way trip and $6.00 for a round trip. Learn more.

Appointments for rides must be made in advance by calling the Paratransit scheduling office at 908-241-8300. Call Monday through Friday 7:00 a.m. to 4:30 p.m.

Try to schedule appointments between 10:00 a.m. & 1:00 p.m. The Paratransit system offers curb-to-curb service only. Assistance may be provided by an aide traveling with the veteran.

Education and Training

Union County Human Services

Feds Hire Vets

Website fedshirevets.gov/index.aspx

Phone 202-606-7304

Health Clinics

VA Healthcare System at Lyons

151 Knollcroft Road

Lyons, NJ 07939

908-647-0180

VA Healthcare System at East Orange

385 Tremont Avenue

East Orange, NJ 07018

973-3434 or 1455

DD-214

Contact the National Archive’s National Personnel Record Center

- DD-214

- Website

- Address National Personnel Records Center, Military Personnel Records, 9700 Page Ave, St. Louis, MO 63132-5100

- Phone 314-801-0800

- Fax 314-801-9195

- Disability Letter

- Call – 1-800-827-1000

- Website

End Of Life

- Wills and Probate

- Administration of an Estate

When a veteran passes away, the Union County Office of Veterans’ Affairs will help in obtaining the following VA benefits:

- headstone and markers, burial flags

- reimbursement of burial expenses and burial in VA National Cemetery.

VA covers the cost of headstones/burials in VA cemeteries, and costs are not covered in private cemeteries.

We are here to help you file all of the necessary paperwork to ensure you receive the benefits you deserve.

Learn more at ucnj.org/surrogate or by calling 908-527-4280.